Commodities

The oldest market in the world can now be traded in new ways

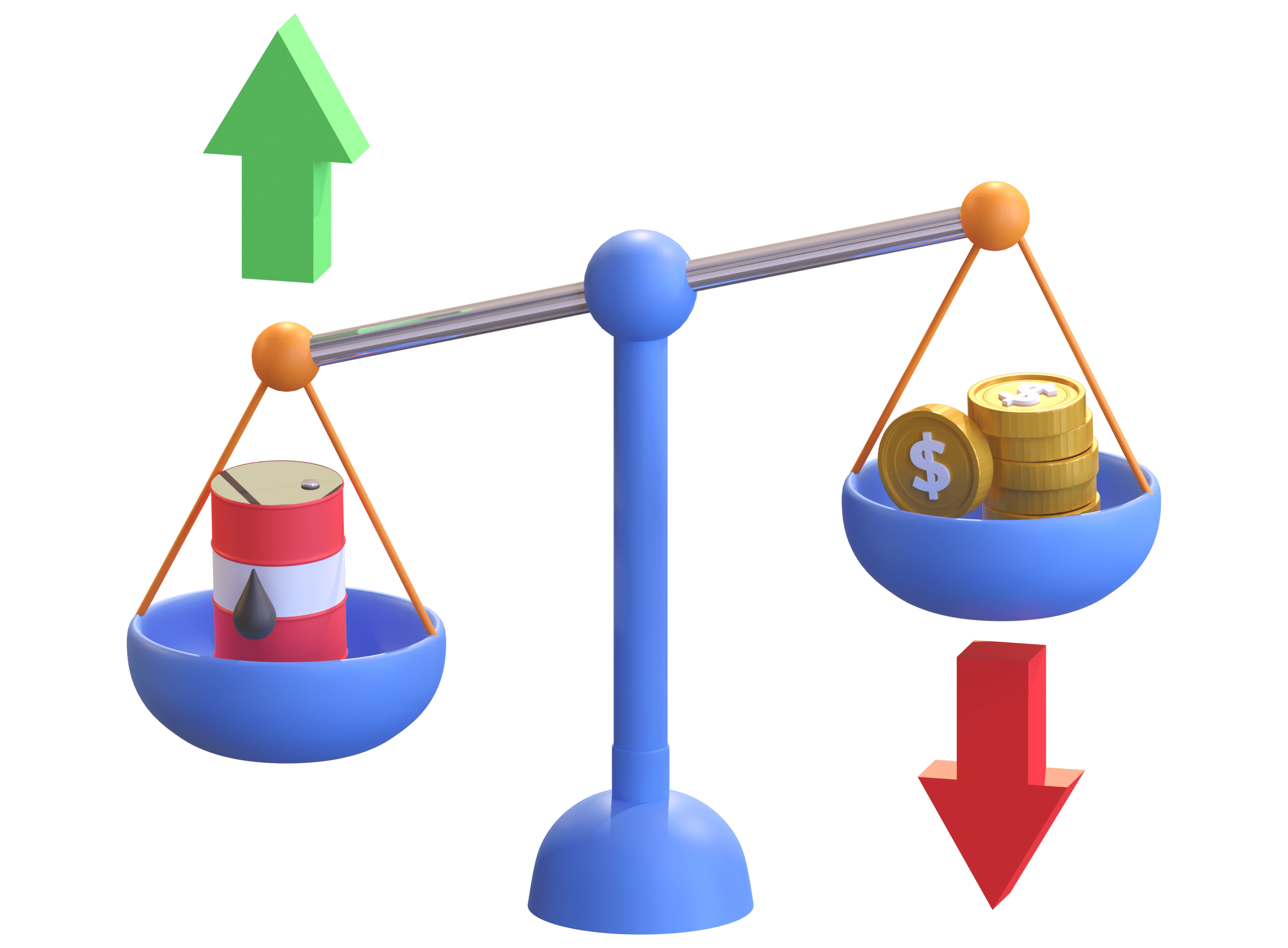

Use the leverage of up to 1:500 and spreads starting at 0.0 pips* to speculate on the fundamental price of commodities such as oil, gold, gas, and more.

Commodities

What are Commodities?

The oldest type of trading, notably for futures, is probably commodity (or "commodities") CFD trading. You can trade on the performance of commodities rather than physically holding the assets thanks to them.

This relates to the purchasing, selling, and trading of harvested soft commodities and hard commodities that are mined (such as oil, gold, and gas) (such as coffee & sugar).

Precious metals (gold, silver, palladium, and copper), agricultural (coffee, cocoa), energy (Brent Crude Oil, WTI oil, natural gas), and livestock are the four categories that commodities are typically addressed under (meat).

Use the leverage of up to 1:500 and spreads starting at 0.0 pips* to speculate on the fundamental price of commodities such as oil, gold, gas, and more.

Commodities

What are Commodities?

The oldest type of trading, notably for futures, is probably commodity (or "commodities") CFD trading. You can trade on the performance of commodities rather than physically holding the assets thanks to them.

AGRICULTURE

Monitor the performance of soft commodities that are traded globally, such as Coffee, Cotton, and Cocoa.